https://ausmarhomes.com.au/wp-content/uploads/2024/04/Blog-Hillside-Estate-Feature-Image-1030-x-700-2.jpg

700

1030

Kylie Jorgensen

https://ausmarhomes.com.au/wp-content/uploads/2022/11/Ausmar-Homes-New-Logo.svg

Kylie Jorgensen2024-04-17 07:00:532024-04-17 14:07:39A Look Inside Caitlyn’s Acreage Dream

https://ausmarhomes.com.au/wp-content/uploads/2024/04/Blog-Hillside-Estate-Feature-Image-1030-x-700-2.jpg

700

1030

Kylie Jorgensen

https://ausmarhomes.com.au/wp-content/uploads/2022/11/Ausmar-Homes-New-Logo.svg

Kylie Jorgensen2024-04-17 07:00:532024-04-17 14:07:39A Look Inside Caitlyn’s Acreage DreamSAVE UP TO

$18,000

Don’t sacrifice for quality or affordability. For a limited time, we’re offering 5% off the base price of first series homes. You can save up to $18,000 and we will go straight to contract within 4 weeks.

SAVE UP TO

$18,000

Don’t sacrifice for quality or affordability. For a limited time, we’re offering 5% off the base price of first series homes. You can save up to $18,000 and we will go straight to contract within 4 weeks.

NEW UPGRADES

FOR $1990

Build your dream home, without the luxury price tag. Your choice of upgrade from three amazing offers including our Ducted Package, Designer Package, or Essentials Package for only $1990.

NEW UPGRADES

FOR $1990

Build your dream home, without the luxury price tag. Your choice of upgrade from three amazing offers including our Ducted Package, Designer Package, or Essentials Package for only $1990.

STANDARD

INCLUSIONS

Experience the joy of living in your stunning new home, complete with elevated standard inclusions that go above and beyond. A testament to AUSMAR’s commitment to quality and value.

STANDARD

INCLUSIONS

Experience the joy of living in your stunning new home, complete with elevated standard inclusions that go above and beyond. A testament to AUSMAR’s commitment to quality and value.

NEW SUNSHINE COAST DISPLAY HOMES

AUSMAR is the number one destination for new home builders on the Sunshine Coast and surrounds. Step inside an AUSMAR home and immerse yourself in our exceptional designs at our conveniently located display home locations in South East Queensland.

Can’t visit us in person? Explore our stunning display homes through virtual tours on our website.

NEW SUNSHINE COAST DISPLAY HOMES

AUSMAR is the number one destination for new home builders on the Sunshine Coast and surrounds. Step inside an AUSMAR home and immerse yourself in our exceptional designs at our conveniently located display home locations in South East Queensland.

Can’t visit us in person? Explore our stunning display homes through virtual tours on our website.

LATEST CASE STUDIES

HILLSIDE

ESTATE

Nestled amidst the tranquil town of Southside Gympie, Hillside Estate is a magnificent acreage property that embodies the essence of modern living.

HILLSIDE

ESTATE

Nestled amidst the tranquil town of Southside Gympie, Hillside Estate is a magnificent acreage property that embodies the essence of modern living.

HAMPTONS

HOMESTEAD

Delve into the captivating journey of AUSMAR’s Custom Acreage Lifestyle Home – an embodiment of elegance, functionality, and meticulous craftsmanship.

HAMPTONS

HOMESTEAD

Delve into the captivating journey of AUSMAR’s Custom Acreage Lifestyle Home – an embodiment of elegance, functionality, and meticulous craftsmanship.

ART

HOUSE

We are proud to showcase the extraordinary journey of Joshua Reilly and his exceptional AUSMAR home inspired by his deep immersion in the art and interior design world.

ART

HOUSE

We are proud to showcase the extraordinary build journey of Joshua Reilly and his deep immersion in the art and interior design world taking precendence.

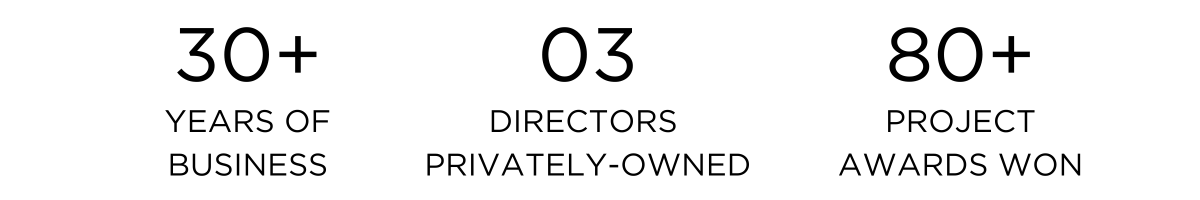

YOUR NEIGHBOURHOOD BUILDERS

EST. COOROY 93′

What started off as a crew of 4 in a small Cooroy office has boomed into a multi-million dollar Sunshine Coast business. It’s been our mission from day one to inspire, educate and guide our friends, family and community to live better through our biggest passion of home building.

Our values are the foundation of our success 30 years on. We uphold honesty, transparency, and integrity in everything we do. Our team is built on trust, ensuring that every interaction is truthful, honourable, and accountable.

YOUR NEIGHBOURHOOD BUILDERS

EST. COOROY 93′

What started off as a crew of 4 in a small Cooroy office has boomed into a multi-million dollar Sunshine Coast business. It’s been our mission from day one to inspire, educate and guide our friends, family and community to live better through our biggest passion of home building.

Our values are the foundation of our success 30 years on. We uphold honesty, transparency, and integrity in everything we do. Our team is built on trust, ensuring that every interaction is truthful, honourable, and accountable.

DISCOVER YOUR PERFECT BUILD

FIRST SERIES

Thoughtfully designed Sunshine Coast homes for first home-buyers, downsizers, and those seeking modern comfort at an affordable price, with uncompromising quality in every aspect.

FIRST SERIES

Thoughtfully designed Sunshine Coast homes for first home-buyers, downsizers, and those seeking modern comfort at an affordable price, with uncompromising quality in every aspect.

DESIGNER

Luxury and functionality combined in stunning award-winning home designs for larger families and those seeking a life of refinement, creating a timeless personal sanctuary.

DESIGNER

Luxury and functionality combined in stunning award-winning home designs for larger families and those seeking a life of refinement, creating a timeless personal sanctuary.

CUSTOM

From acreage properties to challenging sites, split-level designs, and luxurious residences, we build our custom homes with meticulous attention to detail and unrivaled craftsmanship.

CUSTOM

From acreage properties to challenging sites, split-level designs, and luxurious residences, we build our custom homes with meticulous attention to detail and unrivaled craftsmanship.

A MILLION DOLLAR

DIFFERENCE

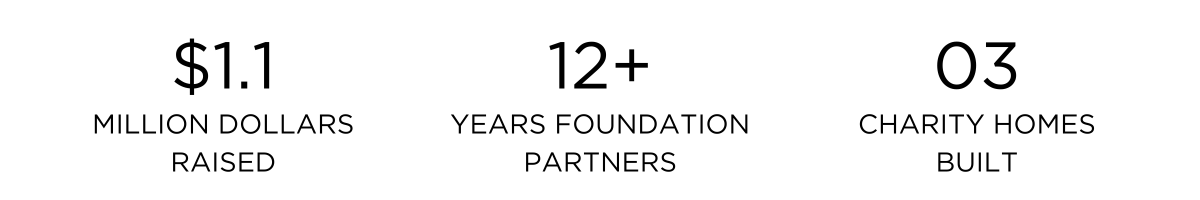

FOR CHARITY

What sets us apart as the Sunshine Coast’s largest local builder is our deep-rooted connection to the community. Over the past 12+ years, we have raised over $1.1 million for the local health Foundation, Wishlist, showcasing our commitment to giving back.

As Foundation Partners for more than a decade, we are passionate about making a positive impact by providing funds for vital medical equipment, support services, research and hospital accommodation in our Sunshine Coast and Gympie regions.

A MILLION DOLLAR

DIFFERENCE

FOR CHARITY

What sets us apart as the Sunshine Coast’s largest local builder is our deep-rooted connection to the community. Over the past 12+ years, we have raised over $1.1 million for the local health Foundation, Wishlist, showcasing our commitment to giving back.

As Foundation Partners for more than a decade, we are passionate about making a positive impact by providing funds for vital medical equipment, support services, research and hospital accommodation in our Sunshine Coast and Gympie regions.

EXPLORE WHAT’S POSSIBLE

CUSTOM

Experience the epitome of luxury and personalisation with an AUSMAR custom home, meticulously crafted to reflect your unique vision and lifestyle.

CUSTOM

Experience the epitome of luxury and personalisation with an AUSMAR custom home, meticulously crafted to reflect your unique vision and lifestyle.

COMMERCIAL

Transform your vision into reality with AUSMAR Commercial, offering innovative solutions for fitness facilities, commercial spaces, and community accommodations.

COMMERCIAL

Transform your vision into reality with AUSMAR Commercial, offering innovative solutions for fitness facilities, commercial spaces, and community accommodations.

RESIDENTIAL

Explore your range of standard plans, meticulously designed for those seeking stylish and functional homes with a focus on comfort and convenience.

RESIDENTIAL

Explore your range of standard plans, meticulously designed for those seeking stylish and functional homes with a focus on comfort and convenience.

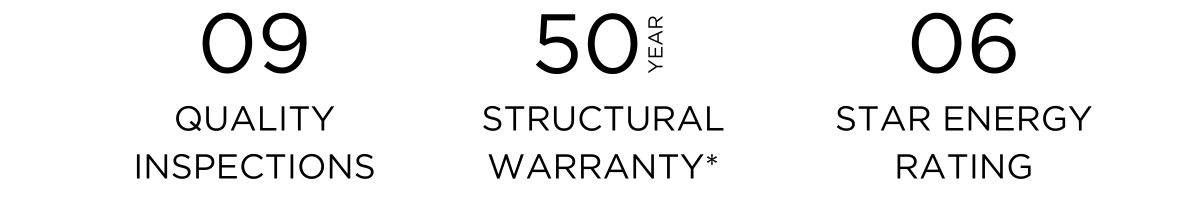

WHY AUSMAR

MORE TO LOVE

What sets us apart is the unwavering passion of our three Directors, who are hands-on home builders actively shaping every project with expertise and dedication.

Our tailored solutions cater to a diverse audience, whether you’re a first-time buyer embarking on the exciting journey of homeownership, a seasoned buyer seeking your ideal home, an investor in search of profitable opportunities, or a downsizer yearning for comfort.

With multiple awards to our name, we are the Sunshine Coast’s largest local builder, renowned for our craftsmanship and commitment to customer satisfaction. Beyond structures, our presence and community contributions stand as a testament to our commitment to turning dreams into reality.

WHY AUSMAR

MORE TO LOVE

What sets us apart is the unwavering passion of our three Directors, who are hands-on home builders actively shaping every project with expertise and dedication.

Our tailored solutions cater to a diverse audience, whether you’re a first-time buyer embarking on the exciting journey of homeownership, a seasoned buyer seeking your ideal home, an investor in search of profitable opportunities, or a downsizer yearning for comfort.

With multiple awards to our name, we are the Sunshine Coast’s largest local builder, renowned for our craftsmanship and commitment to customer satisfaction. Beyond structures, our presence and community contributions stand as a testament to our commitment to turning dreams into reality.

LATEST BLOGS

Client Success Stories

STEVEN CRAWFORD

Great local builders who have high standards and are well priced per square metre. Staff are focused and positive. The build process has been fine and I would build with them again. We built a Manhattan in Moffat Beach.

★ ★ ★ ★ ★

LOUISA BLENNERHASSETT

We had an excellent, smooth experience from start to finish on our new build with AUSMAR Custom – definitely recommend Marc and the team. The finished product is high quality, great design and follow up service excellent.

★ ★ ★ ★ ★

ROD WILCOX

An amazing experience with AUSMAR who has helped us create our dream home. Very professional throughout the design and estimating stage. More comments to come in regards to the build but so far – it’s easily 5 stars.